2017 Rate Request Early Look: Indiana

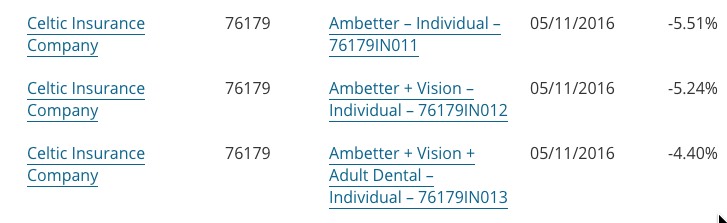

Last year, Indiana was one of only two states to see virtually flat year over year premium increases on the ACA-compliant individual market, with rates going up a mere 0.7% on average. This year, unfortunately, that won't be the case...although at least one carrier, Celtic, is reducing their average rates by over 5%.

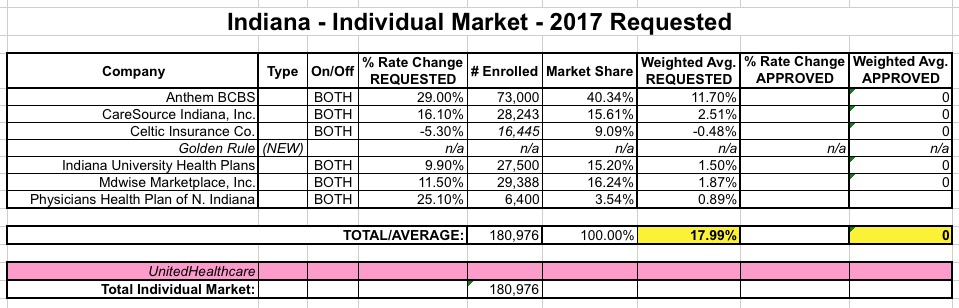

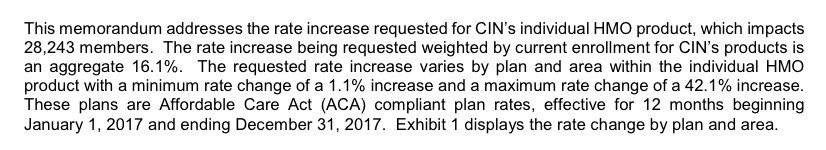

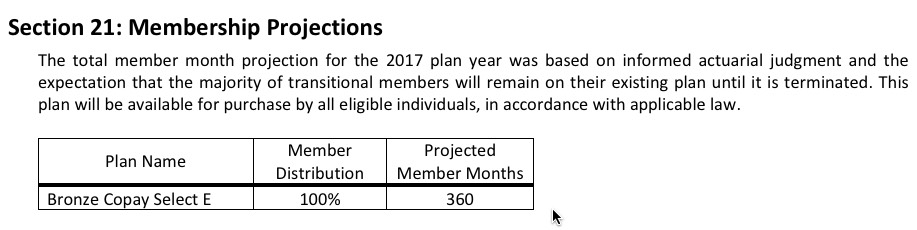

The good news is that I was able to track down the average rate change for all 6 carriers offering individual plans in Indiana (UnitedHealthcare is dropping out of the market, and I'm not sure what's going on with Aetna and Coordinated Care Corporation, both of which do have listings in Indiana's SERFF database for 2017...but neither of which has any actual filings listed. I presume these are placeholders for them to potentially enter the state market, which would be a good thing (and which Aetna has already indicated they might be doing next year). In addition, Golden Rule says that they'll be offering ACA-compliant policies starting next year as well (mainly for their current "transitional" enrollees).

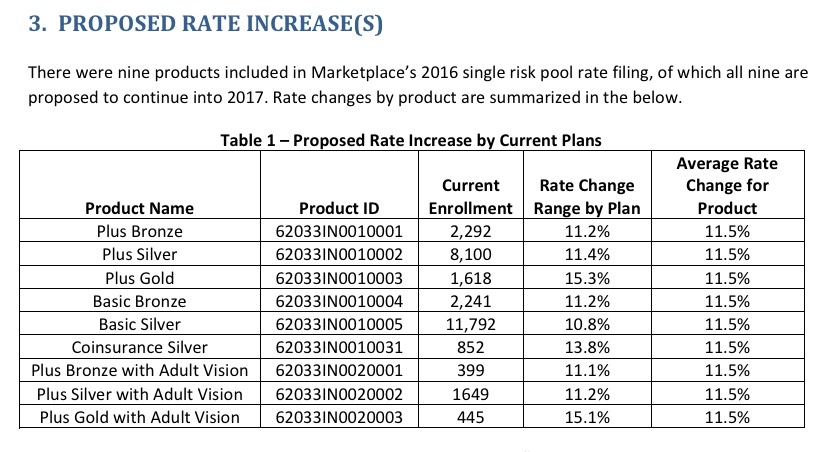

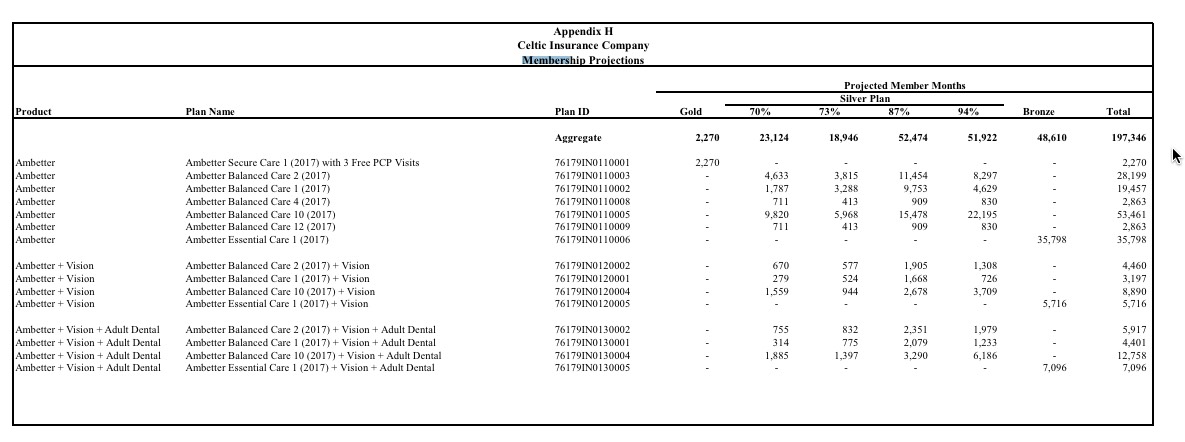

The bad news is that while I've hunted down the current enrollment numbers for 5 of the 6 renewing carriers, one of them, MDwise, is frustratingly unknown, making it tricky to calculate a weighted average rate hike. Actually, I only have hard numbers for 4 carriers; for Celtic I had to cheat a bit by using their projected enrollment for next year. At 197,000 member months, that's an average of around 16,400 enrollees both on & off the exchange.

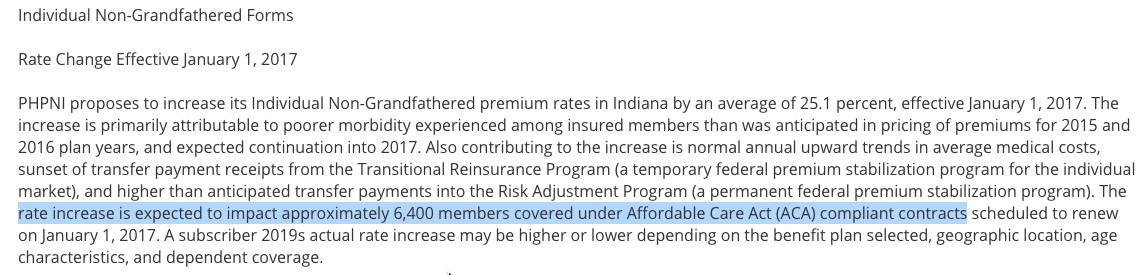

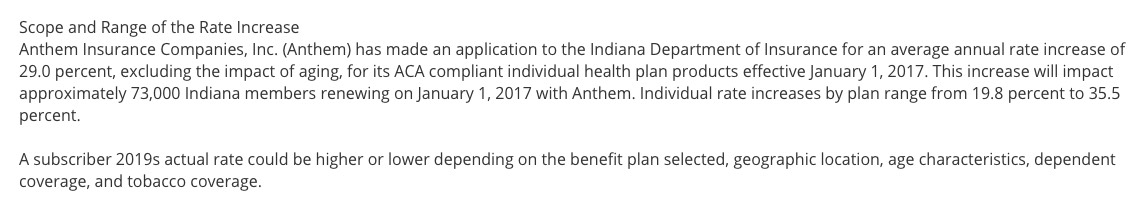

Without MDwise included, the average of the other 5 carriers comes in at 19.25%. However, MDwise is only (only is relative, I realize) requesting an 11.5% average hike, so any additional enrollees from them would bring that average down somewhat. The problem is figuring out how many current enrollees MDwise has:

If you tally up all 5 of the other carriers, you get around 152,000 people. However, Indiana's individual market was over 230,000 in 2014, and has likely grown a good 25% or so since then (from 15.6 million to around 19.5 million nationally), so it's probably up to nearly 290,000 today. I'm assuming that perhaps 10% of these are still enrolled in grandfathered or transitional plans, but that still means that a good 108,000 people are "missing" from the table above.

Some are presumably being dropped from UnitedHealthcare, others from MDwise...but I have no idea how many that might be. The best case scenario would be if MDwise has every single one of them, or 42% of the total; if that's the case, the overall weighted average drops to a 16.0% increase.

Therefore, until further notice, I'm going to assume that Indiana's requested weighted average increase is somewhere between a 16.0 - 19.2%. Using the midpoint (these are all estimates anyway) gives me 17.6%.

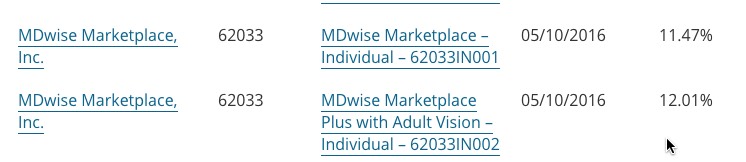

UPDATE: OK, never mind; thanks to farmbellpsu for the catch; I've found MDwise's total current enrollment after all; it's around 29.4K, bringing the overall average requests in at 18% even.

(MDwise below)