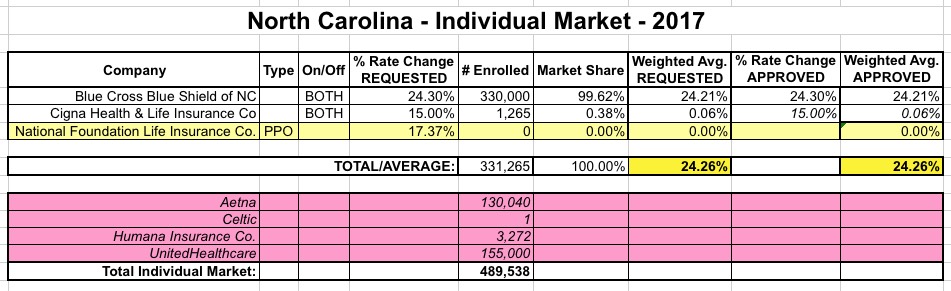

North Carolina: Approved *unsubsidized* avg. 2017 indy mkt rate hikes: 24.3%

Blue Cross Blue Shield of North Carolina originally requested an 18.8% rate hike back in June, but after the Aetna pullout, they revised their request upwards to 24.3%. Cigna, which is expanding onto the ACA exchange next year, followed suit by bumping up their request from 7% to 15%.

I haven't seen any formal announcement from the NC Dept. of Insurance yet, but BCBSNC just posted the following blog entry announcing their 2017 rates...and it certainly looks like the 24.3% request was indeed granted as is:

Blue Cross and Blue Shield of North Carolina customers purchasing ACA plans on the individual market will see an average increase of 24.3 percent in their premiums for 2017, compared to this year’s rates. That’s higher than our original rate filing back in May (an 18.8 percent increase).

Since then, we’ve had to account for a major insurer dropping out of the North Carolina ACA market. That followed a similar decision back in the spring by another carrier to drop out. Blue Cross will enroll an estimated 260,000 of these ACA customers who were left behind by other insurers.

Many of these folks are likely to incur significant medical expenses next year. This is the primary reason we revised our rate filing before deciding to participate in the ACA for 2017 in all 100 counties of North Carolina.

When you hear or read about an average rate increase of 24.3 percent, it’s important to remember two points:

- That figure is based on rates before adding the federal subsidy, which more than 90 percent of people buying on the exchange will qualify for.

- As premiums increase, so does the subsidy.

In fact, when you account for the subsidy, about 72 percent of our ACA customers who enroll through Healthcare.gov will pay less than or the same next year as they’re paying in 2016.

As for Cigna, I don't know if they got their 15% request approved or not, but they have such a tiny portion of NC's individual market anyway (less than 1% from what I can tell), that it really doesn't impact the statewide weighted average anyway (even if Cigna kept rates exactly the same, the average would still be over 24%).

What's most noteworthy here is the fact that there's nothing noteworthy here. That is to say, not only is North Carolina right in the same 23-25% range which I've been finding to be the national average for months now, but once again, unlike the past two years when you saw quite a few carrier requests being whittled down several points by state regulators, this year, the approved rates in most states are coming in very close to (or exactly the same as) the requests from the carriers.