Virginia: Unsubsidized 2024 #ACA rates could shoot up over 25% due to Youngkin insisting on more tax cuts...which also raises some important questions about reinsurance in an ARP/IRA world

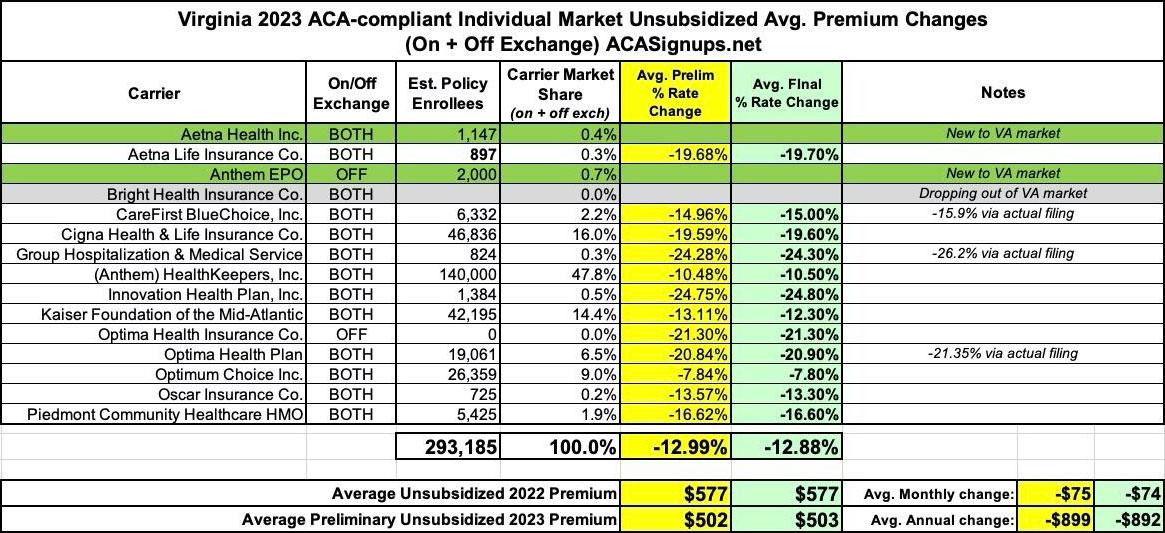

Last year, the final, approved individual market health insurance premiums in Virginia dropped by an impressive 12.9%, ranging from 7.8% to a stunning 24.8%.

The main reason for this was the implementation of a so-called "reinsurance" program which was originally passed by the (then Democratically-controlled) state legislature:

The most significant thing to impact Virginia carriers 2023 filings was the state's Section 1332 Reinsurance Waiver. I wrote about this way back in 2018 when the state was originally considering applying for one, but it didn't actually go into effect until January 2023:

During 2021, the Virginia General Assembly passed HB 2332, the Commonwealth Health Reinsurance Program, which was signed into law on March 31, 2021 as Chapter 480, of the 2021 Virginia Acts of Assembly. This bill requires the State Corporation Commission to submit a waiver request for federal approval to establish a reinsurance program beginning January 1, 2023.

Section 1332 of the Affordable Care Act permits a state to apply for a State Innovation Waiver (also referred to as a section 1332 waiver) to pursue innovative strategies for providing residents with access to high quality, affordable health insurance while retaining the basic protections of the ACA. The program also provides pass-through funding to the state for federal savings from approved initiatives.

The proposed reinsurance program would be funded through state general funds and federal pass-through funding provided under the waiver. It would reimburse carriers in the individual health insurance market for a proportion of the claims of covered individuals with high annual costs. The program is designed to increase affordability in the individual market with a statutory goal of decreasing premiums by up to 20 percent.

...On May 18, 2022, federal reviewers issued a letter approving Virginia’s State Innovation Waiver application to establish the Commonwealth Health Reinsurance Program (CHRP) for an initial period of up to five years, beginning in 2023. Per enactment language, the remaining Virginia statutes establishing the CHRP will become effective on June 17, 2022, 30 days after the Commission provided notice of federal approval.

The CHRP is designed to operate as a traditional reinsurance program by reimbursing ACA individual market health insurers for a percentage of an enrollee’s claims costs exceeding a specified threshold (or “attachment point”) and up to a specified ceiling (or “reinsurance cap”). Specifically, in 2023, the approved program would reimburse claims between an attachment point of $40,000 and an estimated $155,000 cap with a coinsurance rate of 70%. This program is projected to reduce individual premiums in the ACA marketplace by 15.6% for plan year 2023.

Here's my reinsurance explainer. Virginia's is pretty typical, although the actual impact was less dramatic than anticipated--a 12.9% average rate drop instead of 15.6%. Even so, that's a significant reduction.

Most state-based ACA reinsurance programs are in effect for multiple years (I think it's typically 5 at a time, as that's the standard length for Section 1332 waivers before they have to be re-approved). In Virginia's case, however, the program is in jeopardy after only being in place for one year.

As Dave Ress explains at the Richmond Times-Dispatch:

Obamacare health insurance costs in Virginia are set to spike next year because the General Assembly budget impasse means a financial deal that cut premiums has now lapsed, a State Corporation Commission analysis shows.

The analysis projects individual coverage would rise by 28.5% in 2024, after the reinsurance program the state financed — in tandem with a much larger federal sum — cut this year’s premium rates an average of 17.2% from 2022’s average premium rates.

Note: Both of these figures are higher than the ones I have estimated (see below), but that doesn't affect the larger point of the situation.

...According to the analysis, the main reason for the expected spike is the end of the reinsurance program, which this year reimburses health insurers for part of the cost reimbursing health insurers in the Affordable Care Act’s individual market for claims between $40,000 and a $155,000 cap, so that the insurers are out of pocket for 70% of the cost.

...The budget impasse is over Gov. Glenn Youngkin’s push for $1 billion in tax relief. The version of the budget that the Republican-led House of Delegates passed included Youngkin’s tax cuts, while the version the Democratic-led state Senate passed did not, preferring to redirect the money to further increases in K-12 school supports and behavioral health, above the increases Youngkin proposed.

...Tied up in that big dispute is the need for the money committees to say how large a reduction in premiums the state wants to target with the reinsurance.

A bigger reduction target requires a commitment of more state money — but draws down federal funds much faster.

While analysis by the actuarial firm Oliver Wyland stated a 5% target would cost the state $41 million and draw down about $110 million of federal money, a 20% target would cost the state $56.5 million and draw down $498 million in federal money.

...But since the General Assembly budget impasse didn’t make clear what target the state is aiming for, SCC insurance regulators had to assume there’d be no reinsurance, the analysis stated.

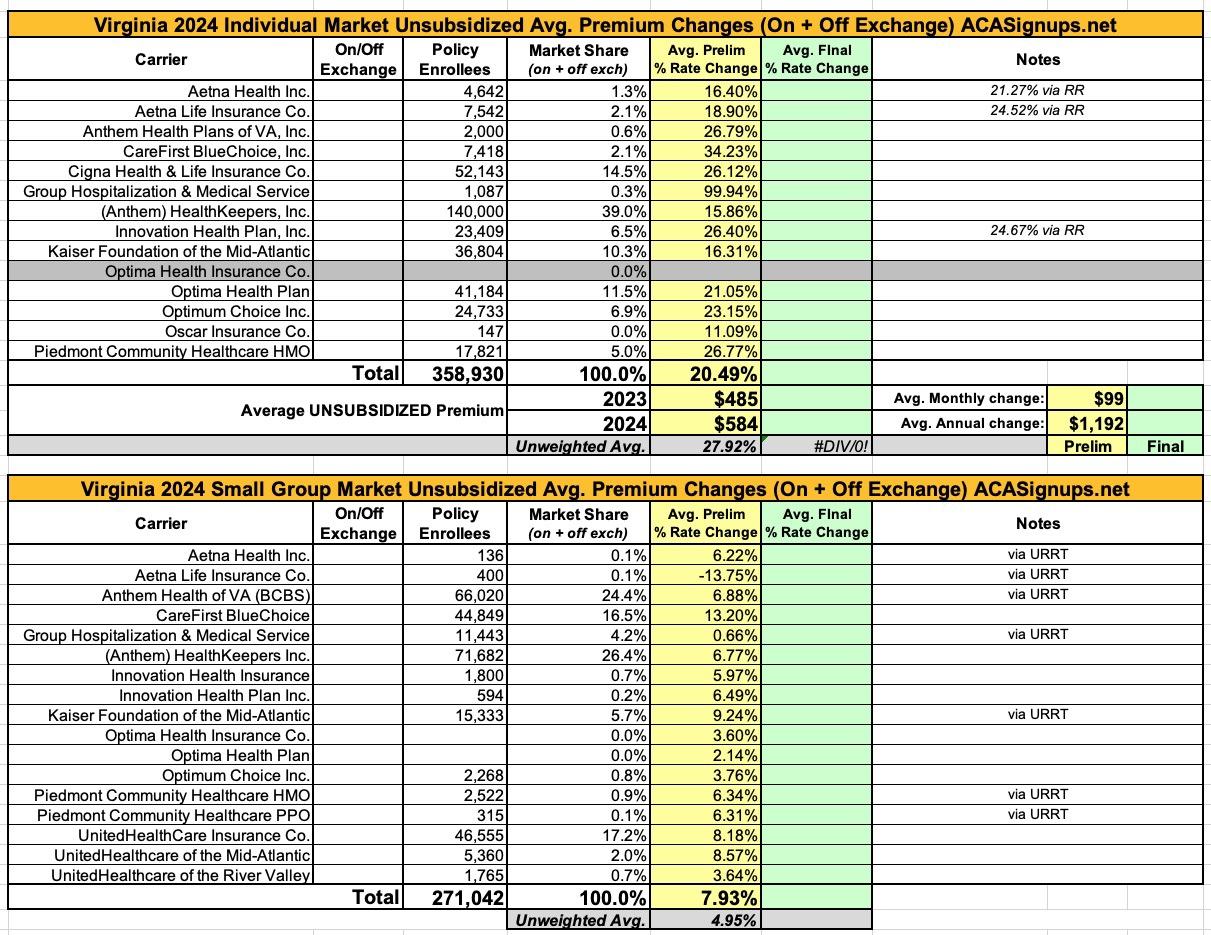

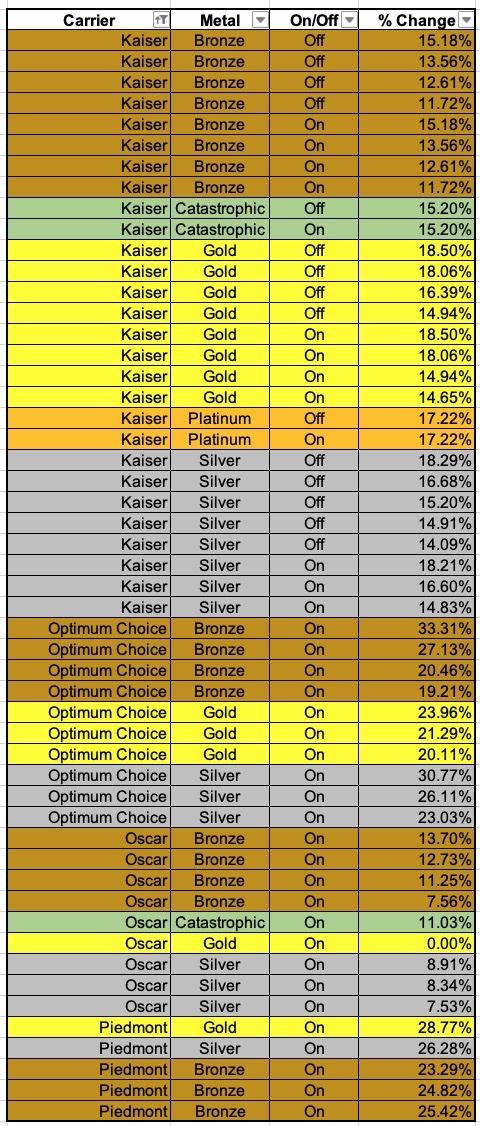

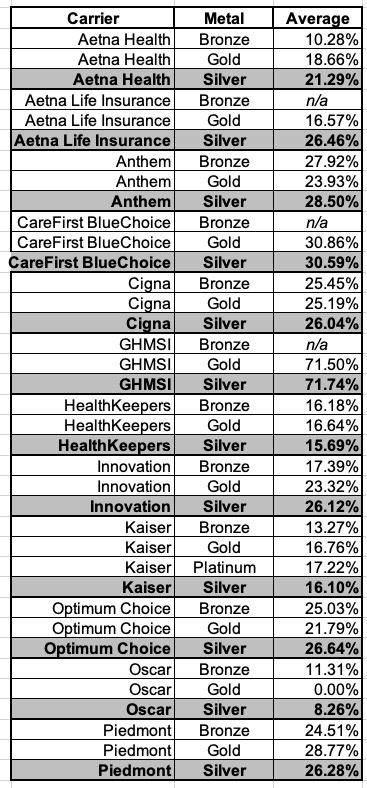

Before I continue, here's my own analysis of the preliminary 2024 individual and small group market rate hikes. As. noted above, just as I had a lower average rate drop on the indy market last year than the article states (-12.9% vs. -17.2%), I also calculate a lower average requested increase next year than the article states (+20.5% vs. +28.5%). I'm not entirely sure what accounts for the differences, but the large point is that premiums for unsubsidized enrollees dropped significantly this year thanks to the program but are set to shoot up dramatically next year if the reinsurance program isn't finalized for the second year.

It's important to note that even if the Virginia legislature does come to an agreement and the program is locked in for 2024, if this happens after the deadline for carriers to sign the final contracts (in mid-September), it will be too late; the 2024 rates will be locked in regardless, although this should also mean massive Medical Loss Ratio refunds being issued the following year.

OK, so assuming the reinsurance battle isn't resolved, unsubsidized premiums for individual market enrollees in Virginia will jump dramatically next year. That's terrible, correct?

Well...that depends.

This year, out of over 333,000 effectuated ACA exchange enrollees in Virginia, 89% are receiving Advance Premium Tax Credits (APTC), while 35% are receiving Cost Sharing Reduction (CSR) assistance. This means that roughly ~180,000 Virginians who are receiving federal tax credits but aren't receiving CSR assistance (most of these earn too much to be eligible for CSR, but some are eligible but chose not to get a Silver CSR plan for whatever reason).

By contrast, there's only around 26,000 Virginians who are completely unsubsidized and are paying full price (the actual number could be slightly higher).

This means that if 2024 premiums jump by the 20.5% (or 28.5%) average noted above, around 26,000 Virginians will be hit hard...but what about the ~180,000 Virginians who receive APTC assistance but aren't enrolled in CSR plans?

Well, here's the thing about reinsurance, as has been repeatedly pointed out by David Anderson and Coleman Drake, among others:

The ARP’s enhanced premium subsidies undercut the logic of state-based reinsurance programs by capping benchmark marketplace premiums at 8.5% of household income for families with incomes above 400% of the federal poverty level.

...Reinsurance can make sense as a corrective measure for idiosyncratic issues within a state’s insurance market. However, the policy challenge is that state lawmakers see reinsurance as a means of lowering gross premiums. That policy objective is now barely relevant for 2021 and 2022. [ed: and 2023-2025 thanks to the Inflation Reduction Act] Depending on the outcomes of the reconciliation bill, extended ARP-like subsidies may continue to render gross premium reduction redundant as a policy goal for several more years or permanently. Reinsurance as a state policy needs to be rethought to either be for smoothing of both actuarial risk (multi-million dollar burns) and likely to be poorly risk adjusted chronic conditions that can generate predictable massive claims where risk adjustment significantly underpays like inhibitor resistant hemophilia.

In a pre-ARP/IRA world where anyone earning more than 400% of the Federal Poverty Level (FPL) has to pay full price for individual market policies, reinsurance makes sense: It reduces full-priced premiums at the expense of making subsidies less generous for those earning less than 400% FPL.

In the ARP/IRA world, however, state-based reinsurance programs of type that Virginia and over a dozen other states have in place make far less sense, as they often harm many of those receiving subsidies without benefitting those who pay full price.

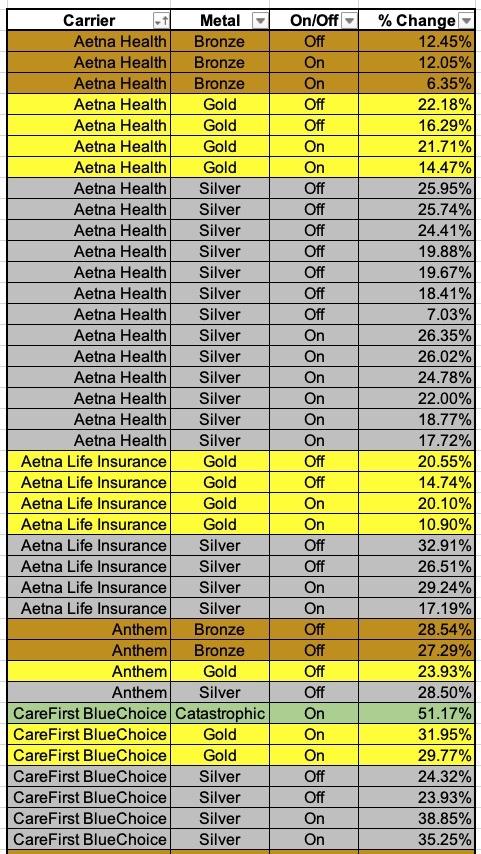

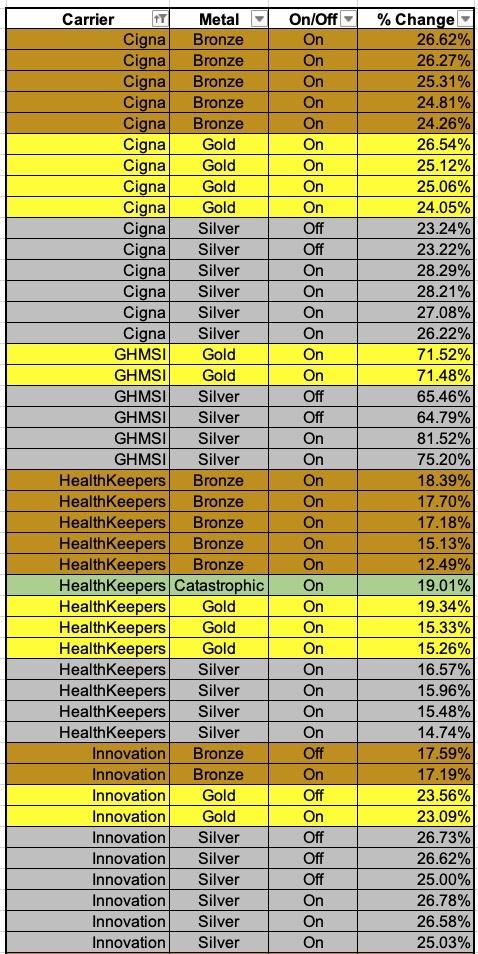

Consider this: The tables below show the preliminary rate increases for every VA ACA plan being renewed next year assuming the reinsurance program isn't kept in place. The last table shows a summary of the average increases of the Bronze, Silver and Gold plans for each carrier:

Overall, it looks like Bronze plans are going up perhaps 19.0%, Silver plans by 27.0% and Gold plans by around 24.5%.

What does that mean for enrollees in terms of subsidies and net premiums?

Well, let's suppose that this year, the average Bronze plan costs $400/mo, the benchmark Silver plan is $500/mo and the average Gold plan is $600/mo.

Let's further say that you have a single adult earning 300% FPL (around $41K/year). This makes them eligible for APTC subsidies but not for CSR.

In a pre-ARP/IRA world, they'd have to pay $333/mo for the benchmark Silver (~9.8% of their income), so they'd receive $167/mo in subsidies. However, they could also apply that towards a Bronze or Gold plan:

- Bronze: $233/mo

- Silver: $333/mo

- Gold: $433/mo

What if they earn just over 400% FPL, however? In the pre-ARP/IRA world, they'd have to pay full price ($400, $500 or $600/month), which could cost them as much as $13.2% of their income, ouch. In that situation, making the subsidies somewhat less generous in order to give a break to the middle-class enrollee via a reinsurance program has some justification: Reducing premiums by, say, 10% would bring the full prices down to $360, $450 or $540/mo. The subsidized enrollee would still be paying no more than $333/mo for the Silver plan. They'd just have to pay a bit more for a Bronze plan ($243...$10 more/month) though they'd pay a bit less for Gold ($423/mo...$10 less/month). Not a bad tradeoff.

However, what happens in the current situation with the enhanced subsidies, where no one has to pay more than 8.5% of their income regardless? Whole different ballgame. Under this scenario, the enrollee earning 300% FPL only pays 6% of their income for the Silver plan, or $204/month; they're receiving $296/mo in APTC:

- Bronze: $104/mo

- Silver: $204/mo

- Gold: $304/mo

Meanwhile, if they earn just over 400% FPL, they no longer necessarily have to pay full price; they're limited to 8.5% of their income at most regardless of how high their income is. This means that at, say, 401% FPL they'd pay $386/month for the benchmark Silver plan...receiving $114/mo in APTC assistance:

- Bronze: $286/mo

- Silver: $386/mo

- Gold: $486/mo

Now, what happens if the reinsurance program isn't implemented for 2024 and the premium hikes go through exactly as requested by the carriers (Bronze +19.0%, Silver +27.0% and Gold +24.5%)?

At full price, you'd get something like this:

- Bronze: $476/mo

- Silver: $635/mo

- Gold: $747/mo

At 300% FPL, the enrollee still only pays $204/month for the Silver benchmark...but they're now getting $431/mo in APTC! This means they can get a Bronze plan for just $45/month or a Gold plan for $316/month (just 4% more than they'd pay this year, vs. the whopping 24.5% more at full sticker price).

Meanwhile, if they earn 401% again in 2024, they'd still pay just $386/mo for the Silver plan...but could also apply the $249/mo towards Bronze or Gold instead. They'd pay just $227/mo for Bronze or $498 for Gold.

- Bronze: $227/mo

- Silver: $386/mo

- Gold: $498/mo

In other words, the very middle-class enrollee who the reinsurance program was designed to help would actually pay $59 less for a Bronze plan without the reinsurance program in place than with it in the ARP/IRA world (and only $12/mo more for Gold). For that matter, they'd pay a whopping $133/mo less for Bronze than the pre-ARP/IRA with reinsurance scenario...and $42/mo less for Gold.

In fact, if every carrier in the state were to also have strict Silver Loading in place (which would likely mean many/most Gold plans being priced below Silver at full price), just about every enrollee would be better off without the reinsurance program in place than with it. The only ones for whom reinsurance would actually save money on premiums at that point would be if they earned over ~$90,000/year (ie, over 660% FPL, or too much to receive any subsidies due to the $635/mo benchmark plan costing less than 8.5% of their income). And if a single adult earns that much, I'm not particularly sympathetic to their plight here.

The biggest unknown right now is whether or not the enhanced ARP/IRA subsidies will be allowed to sunset at the end of 2025 as they're currently scheduled to, or whether they'll be made permanent (or at least extended for another several years). If they end, Virginia's reinsurance program will once again make sense at that point as an imperfect form of middle-class ACA enrollee relief. If they're extended, however, Virginia legislators of both parties should take a good close look at whether continuing the program actually helps more enrollees than it harms.