Rhode Island: *Final* avg. unsubsidized 2024 #ACA rate changes: +5.8%

Original post: 8/16/23

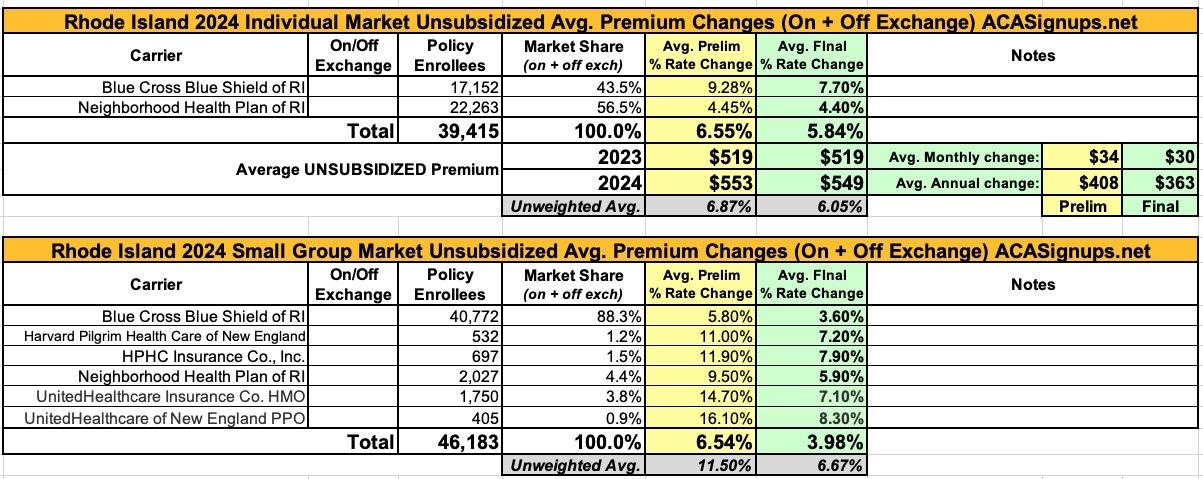

Not a whole lot to report in the smallest (physically) state of the Union. Rhode Island only has two insurance carriers participating in the individual health insurance market, while six of them compete in the small group market. Thankfully, the SERFF database not only has all eight of these filings, each of them has at least one document which includes the actual number of RI residents enrolled in the carriers policies.

As a result, I can run a fully weighted average for both markets: In the individual market, carriers are requesting an average rate hike of 6.6%, while small group market insurers want to bump up premiums by 6.8% overall.

UPDATE 10/03/23: The Rhode Island Insurance Commissioner has issued a press release with the final, approved 2024 rates; the table has been updated below. In the end, individual market policies are going up 5.8% while small group plans are only going up 4.0% on average.

2024 Commercial Health Insurance Rates Have Been Approved with Modifications

CRANSTON, R.I. (September 15, 2023) – Commercial health insurance premiums for 2024 have been approved by the State of Rhode Island’s Office of the Health Insurance Commissioner (OHIC), with modifications. As a result of these changes, Rhode Islanders will save $23.8 million in 2024 compared to what the commercial health insurers requested. In the months since the rate filings were submitted in May, OHIC has reviewed the medical expense trend assumptions, administrative charges, and margin requests for each insurer. Additionally, OHIC staff reviewed the benefit coverage documents for each health plan to ensure compliance with state and federal laws. The approved premiums are predominantly driven by the cost of health care—the increasing unit prices and use of health care goods and services.

In addition to OHIC’s review, the Rhode Island Attorney General’s Office (RIAG) conducted an independent review of rate filings across all markets. The RIAG submitted comments and actuarial reports on each rate filing to OHIC. This year the RIAG’s consulting actuary provided tables in their reports showing a “range of reasonable 2024 rate changes” for each insurer.

Tables 1 – 3, below, summarize the approved rates for 2024 and the enrollment with each insurer, by market, as of March 2023. The rate change approved by OHIC is shown along with the range proposed by the RIAG’s consulting actuary, and the rate change requested by the insurers in the May filings. Overall, the OHIC approved weighted average rate changes are 5.9% for the individual market, 3.9% for the small group market, and 8.5% for the large group market.

...“I firmly believe that all stakeholders, including health insurers, health care providers, and government must share accountability for promoting affordable health care for all Rhode Islanders” said Acting Health Insurance Commissioner Cory B. King. He continued: “The approved premiums strike a balance between the funding needs of Rhode Island’s health care delivery system, actuarial soundness, and affordability. The increasing cost of health care is the principal driver of premiums. Addressing these rising costs requires careful analysis of data, strategic investments in primary care and behavioral health, and collective efforts by insurers, providers, and government to manage cost growth. OHIC is committed to working collaboratively with all stakeholders to promote affordable health insurance.”

Every year payments to health care providers account for the dominant share of the premium dollar. This can be seen in OHIC’s most recently published Rhode Island Market Summary – Part 2: Loss Ratios, Profitability & Risk Adjustment which presents data on the distribution of the premium dollar between claims payments to providers, insurer administrative charges, taxes, and contribution to reserves/profit. For the individual and group markets combined, in 2021, medical and pharmacy claims accounted for 82 cents of the premium dollar, insurer administrative costs consumed 13 cents, state and federal taxes accounted for 3 cents, and 2 cents was retained as profit. In this year’s rate review, OHIC modified proposed rates in a number of ways, including reducing medical expense trend assumptions, cutting insurer administrative charges, and reducing insurer requested profit or contribution to reserve margins. To promote affordability over the long term the cost of health care must be addressed through data-driven strategies.

It's also worth noting that this is the first time I've happened to see the ACA's absurd (but codified) "segregated abortion fee" specifically referenced in a rate filing memo. It's probably been in many of them, but I've never noticed it before:

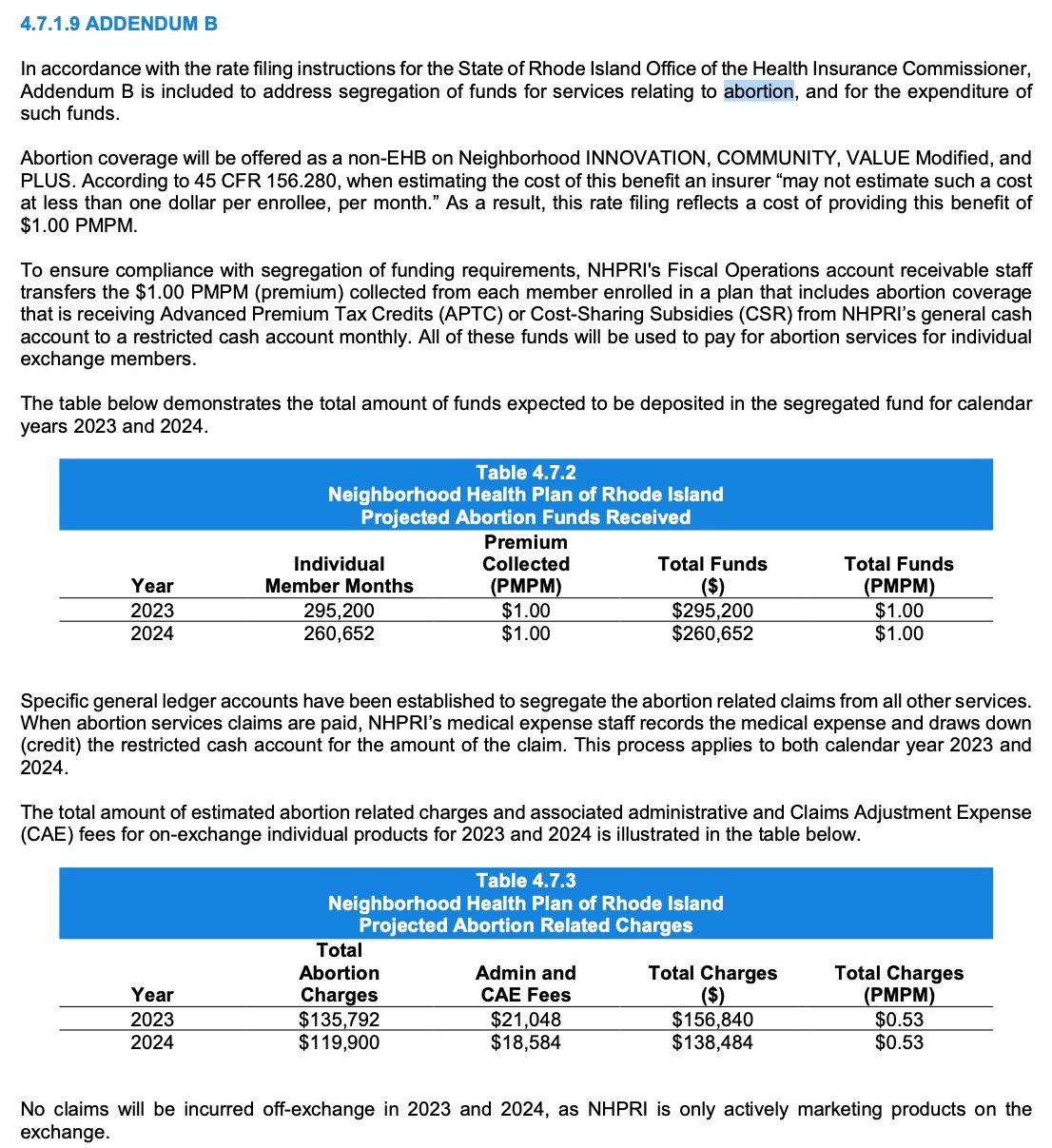

The most noteworthy part about this is this addendum which breaks out something I've been wondering about for years now: Just how much of the mandatory $1/month "abortion rider" fees--which are not legally allowed to be used for any other purpose besides abortion medical claims under the wording of the Affordable Care Act--are actually used for that purpose. As I've long suspected, the answer is far less than the amount deposited into these funds:

In short, only slightly over half the money going into these funds is ever actually being used in Rhode Island every year. This ratio likely varies highly from state to state (especially in states which have banned abortion since last years' Dobbs decision, although many of those states didn't allow insurance policies to cover abortion before Dobbs anyway, and many carriers in the states which did likely didn't choose to include it in their coverage regardless), but the bottom line is that, as I wrote about six years ago, there are likely hundreds of millions of dollars building up in insurance carrier bank accounts around the country which cannot legally be used for any other purpose whatsoever.

This doesn't mean that the carriers are benefitting, however; my understanding of the way the law is worded is that they can't use this money for anything else either, so while it may technically show up in their revenue reports, the unused portion of the money has to just sit there in the account growing interest...and for all I know, the interest may not be able to be used for anything else either.

In Rhode Island's case, over $250,000/year is being deposited into these funds but less than $150,000 is actually being spent on abortion claims each year, which means year after year there's well over $100,000 just building up in coffers in this one tiny state alone, presumably until the end of time (or until the law is modified). And again, this is in a state with only ~40,000 ACA exchange enrollees.