Updated: Arizona: *Final* avg. unsubsidized 2024 #ACA rate changes: +0.4% (unweighted)

The good news is that the federal Rate Review database has now posted the preliminary avg. 2024 rate filings for the individual and small group markets for every state. This makes it very easy to plug in the average requested rate changes in 2024 for every carrier participating in both markets.

The bad news is that most of the underlying filing forms are heavily redacted, meaning I can't use the RR database to acquire the other critical data I need in order to run a proper weighted average: The number of people actually enrolled in the policies for each carrier.

This means that in cases where this data isn't available elsewhere (either the state's insurance department website, the SERFF database or otherwise), I'm limited to running an unweighted average. This can make a huge difference...if one carrier is requesting a 10% increase and the other is keeping prices flat, that's a 5.0% unweighted average rate hike...but if the first carrier has 99,000 enrollees and the second only has 1,000, that means the weighted average is actually 9.9%.

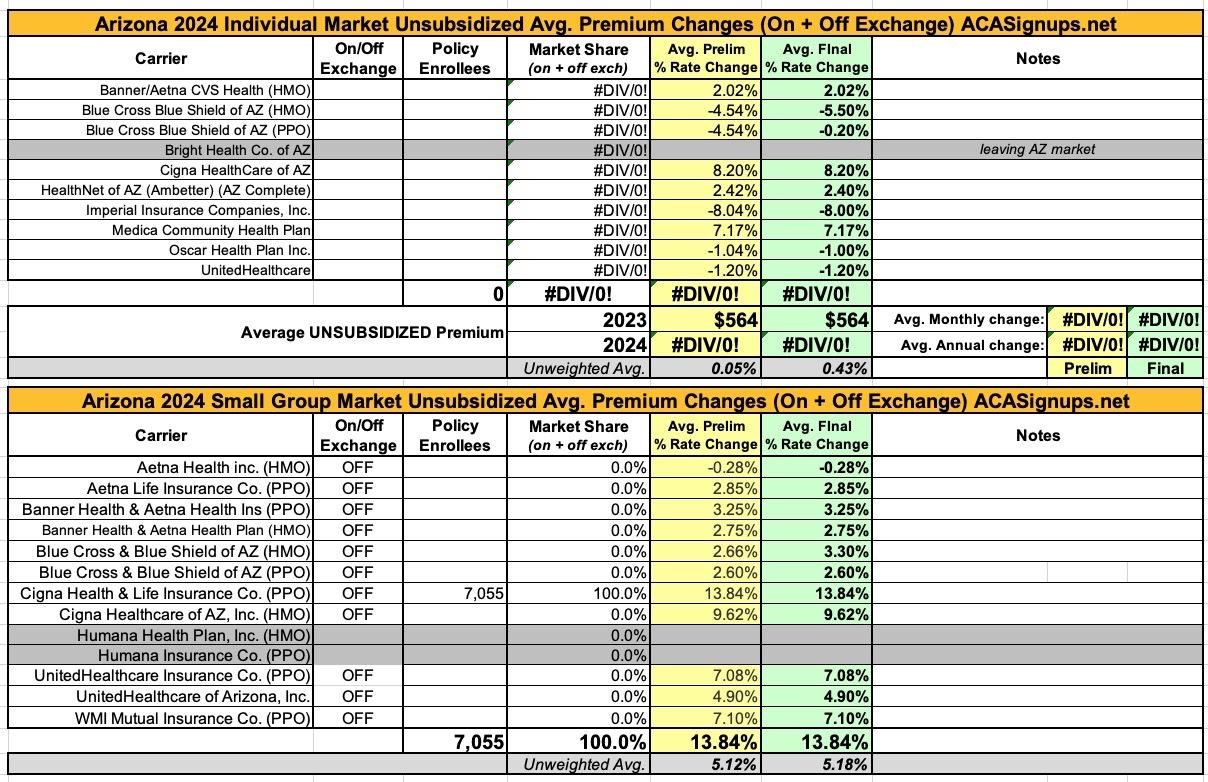

With that in mind, here's the preliminary filings for Arizona carriers: An unweighted average 0.5% reduction on the individual market (ranging from -8.0% +7.2%), and an unweighted average 5.4% increase on the small group market (ranging from -0.3% to +13.8%).

The biggest news on the Arizona ACA market for 2024 is that Bright Healthcare (and Cigna Healthcare, it seems?) are both leaving the individual market, while Humana is pulling out of the states small group market.

UPDATE 10/19/23: The Arizona Insurance Dept. has posted the final, approved rate changes for 2024. Unfortunately, even though the post includes the SERFF Tracking number for every carrier, none of them appear to be showing up in the SERFF database for some reason...so I still can't get the weighted market share/average. Sigh.

On the other hand, this update does clarify that Cigna is not dropping out of the Arizona individual market, and Blue Cross Blue Shield's PPOs are staying roughly even (as opposed to their HMO rates, which are dropping around 5.5 points):

On the small group market there's one carrier (Cigna Health & Life) which is providing a rate justification summary which includes their enrollment number and some other details (although oddly, Cigna's other small group division, Cigna Healthcare of AZ, didn't):

SCOPE AND RANGE OF RATE INCREASE

Cigna estimates that 7,055 customers will be impacted by this rate increase. On average, customers will see an increase of 13.8%, excluding the impact of aging, with a range of increases from 6.9% to 26.6%. In addition to the factors described below, each customer’s rate increase depends on factors such as where they live and what plan they are enrolled in.

SIGNIFICANT FACTORS

The most significant factor contributing to rates in AZ is annualized cost trends as described below.

- Changes in Medical Service Costs: The increasing cost of medical and pharmacy services and supplies accounts for a sizeable portion of the premium rate increases. Cigna anticipates that the cost of medical and pharmacy services and supplies in 2024 will increase over the 2023 level because the prices charged by doctors, hospitals, drug manufacturers and other providers are increasing. Additionally, Cigna's costs are impacted by the higher use of medical and pharmacy services.

EXPERIENCE & PROJECTIONS

Cigna began 2022 with only around 2,000 members in the AZ small group market and therefore has only partially credible experience in the experience period.

Our claims experience indicates that the ratio of claims to premiums for Cigna’s small group plans in AZ will be in excess of the federally defined minimum loss ratio threshold of 80%. The proposed 2024 rate increase is expected to bring loss ratios in line with Cigna's target level. With the proposed rate increases, we expect the loss ratios for our small group plans to be higher than the federally defined minimum loss ratio threshold of 80%, thereby ensuring that the amount of premium spent on claims and quality improvement activities is more than required by the Affordable Care Act. Cigna is committed to using the premiums received from consumers to ensure quality healthcare coverage at an affordable price.