California: Record Financial Assistance Helps “Bridge the Gap” as @CoveredCA Launches 2024 Open Enrollment Campaign

Los Angeles, Calif. — Covered California kicked off its 2024 open-enrollment period at the iconic Los Angeles State Historic Park and Roundhouse Bridge, a public space that serves some of the most vulnerable communities in the state, with roots that connect back to the early history of the city and region…

Covered California Executive Director Jessica Altman was joined by California Health and Human Services Secretary Dr. Mark Ghaly and Assemblymember Miguel Santiago of California’s 54th district to launch open enrollment. They highlighted how record financial help — through enhanced federal premium support and a new program in California that will reduce out-of-pocket costs for over 650,000 consumers — is bridging the gap between uninsured Californians and access to affordable coverage and quality care.

“2024 will be a historic year for health care coverage in California,” said Gov. Gavin Newsom. “Here in the Golden State, we are removing barriers and increasing access as we work to create a healthier California for all.”

The event marked the start of the 11th year of Covered California’s offering affordable, name-brand health care coverage and financial help to Californians under the Patient Protection and Affordable Care Act. Open enrollment, which began today and runs through Jan. 31, 2024, is the time of year when Californians can sign up for health insurance or make changes to their existing health plans.

Covered California is entering this open-enrollment period with over 1.6 million Californians enrolled in coverage.

“There has never been more financial assistance available to help Californians pay for health care through Covered California than there will be in 2024,” said Jessica Altman. “We want every uninsured Californian to know that affordable health care coverage is available and within closer reach than ever before.”

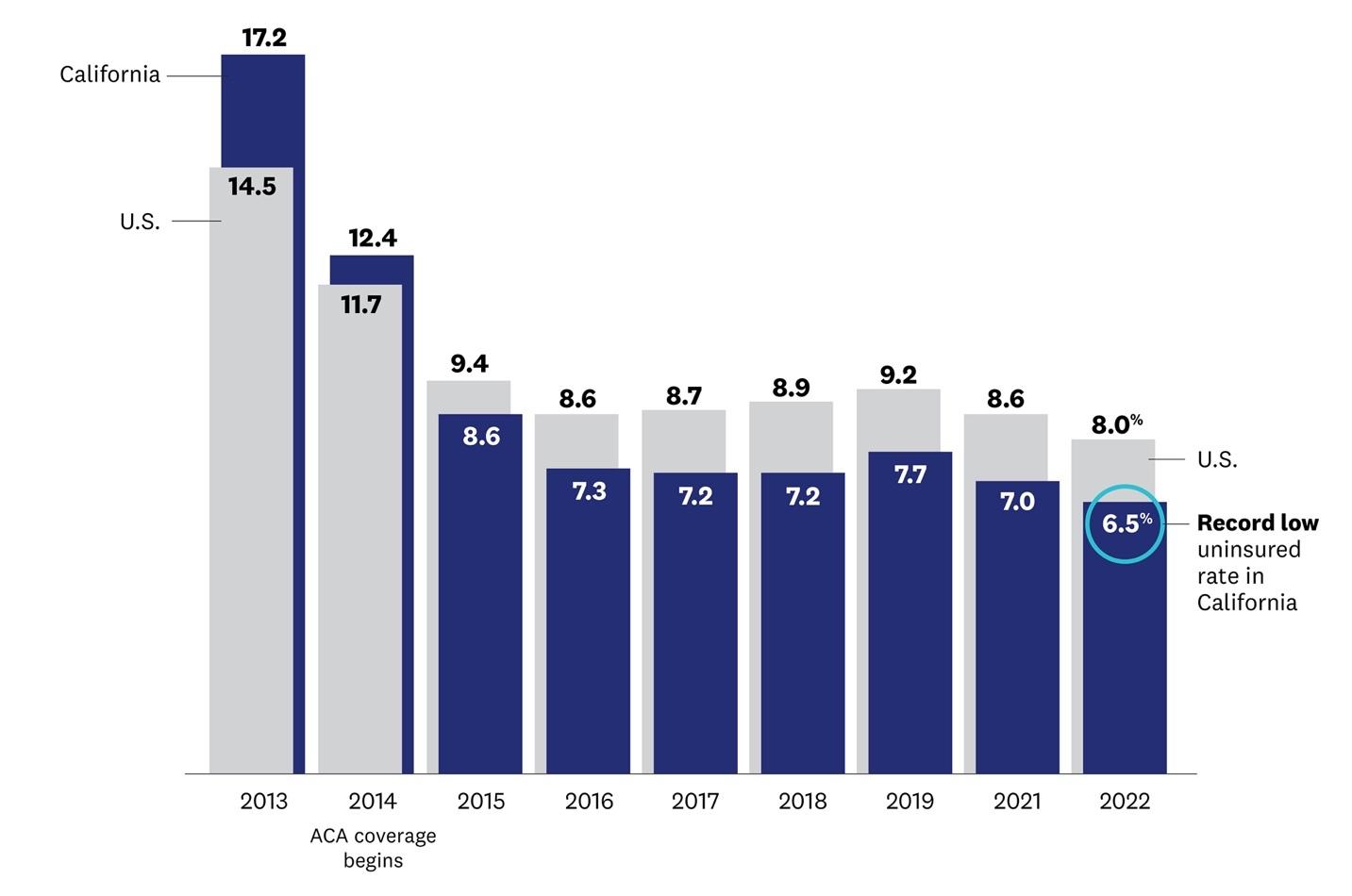

Open enrollment begins with a record-low uninsured rate of 6.5 percent among Californians, according to federal data. Since Covered California’s first open-enrollment period in 2013, California’s uninsured rate has fallen from 17.2 percent to 6.5 percent in 2022, which is the largest percentage point drop for any state in the nation over this time.

Figure 1: California’s Uninsured Rate Continues to Decline, Reaching an All-Time Low in 2022[1]

Next year will bring a significant expansion in health coverage eligibility, as all low-income Californians will be able to enroll in Medi-Cal regardless of their immigration status, as part of Gov. Newsom’s promise of universal access to health care coverage. While those who are not lawfully present do not qualify for a health plan through Covered California due to federal regulations, thanks to a continued partnership with the California Department of Health Care Services, which oversees Medi-Cal, Californians can go to CoveredCA.com or visit a certified enroller to find out more about what coverage they may be eligible for and apply.

While the opportunity to get more Californians covered is tremendous, the latest data from the California Simulation of Insurance Markets (CalSIM), a model created by the UCLA Center for Health Policy Research, shows that significant gaps remain between those with and without insurance. CalSIM estimates that there are over 1.3 million uninsured Californians who either qualify for subsidies through Covered California (606,000) or are eligible for Medi-Cal coverage (714,000).

Nearly 500,000 of those eligible for coverage reside in Southern California. Covered California has enrollment assistance available in more than 50 languages for those eligible in Los Angeles County, Orange County, or the Inland Empire.

Bridging the Gap

The theme for this year’s campaign, “Bridging the Gap,” emphasizes the role Covered California plays in connecting uninsured Californians with health insurance. Covered California is currently focused on serving as a bridge for those who are no longer eligible for Medi-Cal or lost their employer-based coverage.

With the end of the federal continuous coverage requirement in March, Medi-Cal began its year-long renewal and redetermination process for more than 15 million members in April. To help those deemed no longer eligible for Medi-Cal, Covered California launched its auto-enrollment program to eliminate gaps in coverage and aid a seamless transition from Medi-Cal to a health plan offered by Covered California.

Consumers who have been auto-enrolled in a Covered California plan must take action to start their coverage, by opting in or by paying for their first month’s premium, if one is required — and crossing over into coverage with the exchange.

Thanks to this program, thousands of Californians have kept their coverage so far. People who have questions about the redetermination process, Medi-Cal or financial help should contact Covered California for free, confidential help.

Bridging the Gap in Affordability

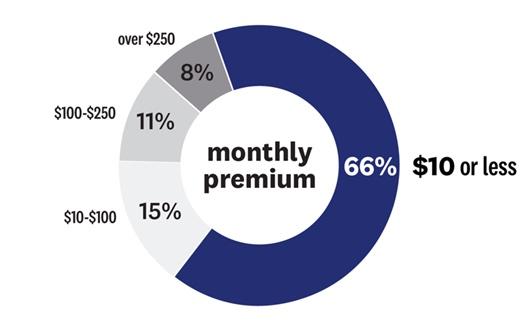

Nearly 70 percent of uninsured Americans cite cost as the primary barrier to health care coverage. Covered California is bridging this gap for the 2024 plan year by offering more financial help than ever before. It will build on the existing federal subsidies with a new program that will reduce out-of-pocket costs for over 40 percent of current consumers, saving them money when they receive medical care. Nearly 90 percent of Covered California’s enrollees receive financial help and currently, two-thirds of Covered California’s consumers are eligible for comprehensive health insurance at a cost of $10 or less per month, and nearly half could get a comprehensive Silver plan for that price.

Figure 2: Most Covered California Consumers Are Eligible for Health Plans for $10 or Less Per Month

The biggest change in 2024 for over 650,000 Covered California enrollees — and new consumers who qualify — will be California’s new program to reduce out-of-pocket costs.

The program will reduce the cost of accessing health care for Covered California enrollees by lowering their out-of-pocket costs when they seek medical care, including eliminating deductibles in all three Silver cost-sharing reduction plans.

To help ensure that the greatest number of enrollees can take advantage of these cost savings and richer benefits, Covered California plans to automatically move about 35,000 eligible enrollees from other metal tier plans into Silver cost-sharing reduction plans, if they qualify. Many more enrollees will be able to switch to one of these plans to take advantage of the new benefits.

These benefits will be available for Californians with incomes up to 250 percent of the federal poverty level, or $33,975 for single enrollees and $69,375 for families of four.

Bridging the Gap in Health Disparities

This year’s theme also reflects Covered California’s commitment to bridging the gap in health disparities.

Enrolling consumers in health insurance is critically important and advancing health equity to ensure that California’s diverse populations have the resources and opportunities they need to thrive is also paramount.

Covered California’s Chief Medical Officer, Dr. Monica Soni, brings passion and enthusiasm to her role of advancing health equity.

“Our guiding mission is to ensure that once you open the door to having insurance, you also cross the threshold into receiving accessible care,” Dr. Soni said. “Coverage is critical, but coverage doesn’t equate to access. We want everyone with coverage to have a meaningful relationship with a primary care provider and receive life-saving and life-sustaining, free preventive care. The road to wellness for you and your family begins there.”

In 2022, Covered California coverage facilitated 3.3 million primary care visits for our members and nearly 1.1 million behavioral health visits. Of those behavioral health visits, 76 percent occurred virtually, helping Covered California members get care where they want it and when they need it.

Signing Up for Coverage Is Easy

Consumers can learn more about their options by visiting CoveredCA.com, where they can easily find out if they qualify for financial help and see the coverage options in their area. Those interested in learning more about their coverage options can also:

- Get free and confidential assistance over the phone, in a variety of languages, from one of more than 14,000 certified agents and community-based organizations throughout the state that provide free, confidential help in whatever language or dialect consumers prefer.

- Have a certified enroller call them and help them for free.

- Call Covered California at (800) 300-1506.

The deadline to select a health plan and have coverage for all of 2024 is Dec. 31.

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the legislature. For more information about Covered California, please visit CoveredCA.com.