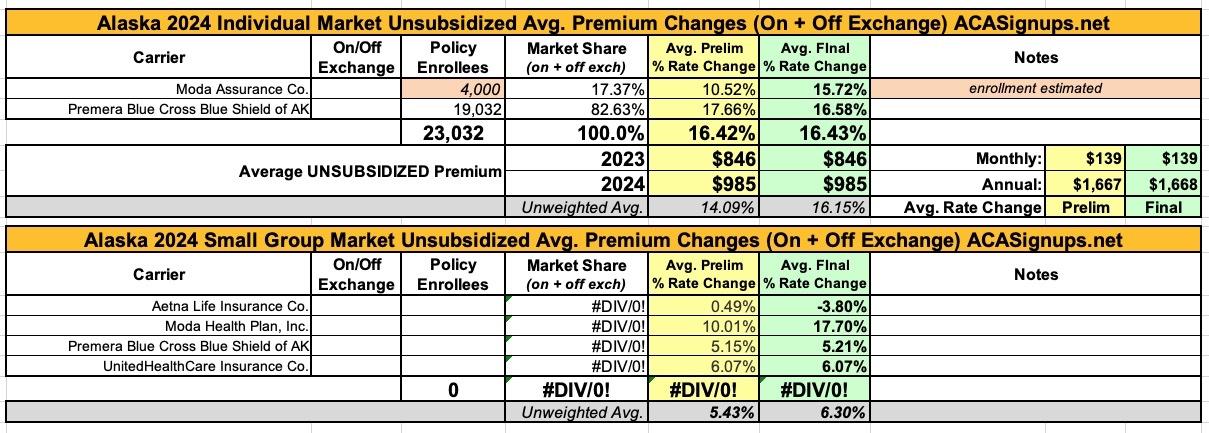

Alaska: *Final* avg. unsubsidized 2024 #ACA rate changes: +16.4% (updated)

Originally posted 8/07/23; updated 11/02/03

Alaska is a sparsely populated state with only two carriers on their individual market and four on their small group market. Alaska's insurance department website is useless when it comes to getting rate filings or enrollment data; I had to use the federal Rate Review site to even get the requested rate changes.

Fortunately, Premera Blue Cross includes a summary which lists their enrollment numbers, and with Moda being the only other carrier on the market, I was able to estimate a weighted average (assuming Moda has around 4,000 enrollees, which seems about right given Alaska's total on-exchange enrollment of roughly 25,500 people during Open Enrollment; effectuated enrollment as of last spring is almost certainly a couple thousand lower overall).

From Premera's summary:

Premera Blue Cross Blue Shield of Alaska (PBCBSA) is renewing eight existing metallic plans, discontinuing one federal standardized plan, and adding one new federal standardized plan. All plans will be sold on the Federally Facilitated Exchange.

Scope and range of the rate increase: Premera currently has 19,032 members on metallic plans.

The 2024 average rate increase is 17.8%, which varies by plan from 16.2% to 18.6%. The rate increase is primarily due to medical and pharmacy costs and utilization inflation and renewal claims experience that is running more adversely than assumed in the current rates. Shown at the end of this document is the 3-year financial results. In 2022, Premera reported a financial loss of $26.5M for this block.

The rate increase would have been 4.5% higher if not for the removing of the 80% UCR requirement for out-of-network (OON) providers. The savings assumed the proposed out of network reimbursement of 300% of CMS for ESRD claims and 125% of CMS for all other OON services. This matches the current reimbursement rates provided to out of network providers for our Washington book of business (outside of Alaska).

The other main contributors to the rate increase are the med/Rx claims trend of 9.4% and an 7.4% adjustment for the change in morbidity of members that choose to renew or purchase coverage with Premera.

Changes in benefits:

Premera proposed to change member cost share in 2024. All claims from the Participating providers will be accumulating toward the in-network deductible and out-of-pocket accumulators. Bronze 5800 HSA had a slight increase in out-of-pocket maximum (OOPM). Due to changes in the federal standardized plan options, the Standard Gold deductible will be lowered by $500 and the Standard Silver’s deductible and OOPM increased by $100 and $200. In addition, the federal standardized bronze option currently offered by Premera will be discontinued. For 2024 Premera will offer a Standard Bronze II plan based on the expanded bronze option. These changes impact the cost by 2.0% and accordingly lower the required rate increase.

Changes in Medical Service Costs:

For Premera’s individual metallic business, the annual medical and pharmacy services cost inflation is expected to be 4.4% with an additional increase in utilization of services of 4.6% per annum.

Administrative costs and anticipated profits:

Premera is committed to using its members’ rate dollar responsibly and consistently to pay out a high percentage of the members’ rate dollar on medical claims. Premera expects to exceed the ACA’s required Medical Loss Ratio (MLR) for this line of business in 2024.

Taxes and fees, including fees paid toward the Federally-Facilitated Exchange, account for 4.6% of the rate dollar in 2024.

The other administrative cost (Administrative Expense Load) account for 6.6% of premium which has decreased 0.2% since the prior year.

All of this adds up to a weighted average requested rate hike of 16.4% in Alaska, among the highest I've seen so far this year.

On the small group market, the unweighted average increase is 5.4%.

UPDATE 11/02/23: The final/approved rates have been posted; while Moda's rate request has been increased dramatically (from 10.5% to 15.7%), it was offset by Premera's reduction from +17.7% to +16.6%. Since Premera has a much larger market share, this effectively cancels out the Moda hike.

Two of the four small group plans had dramatic changes, howver...Aetna will see rate reductions of 3.8% and Moda's increase will average 17.7% instead of 10.0%.