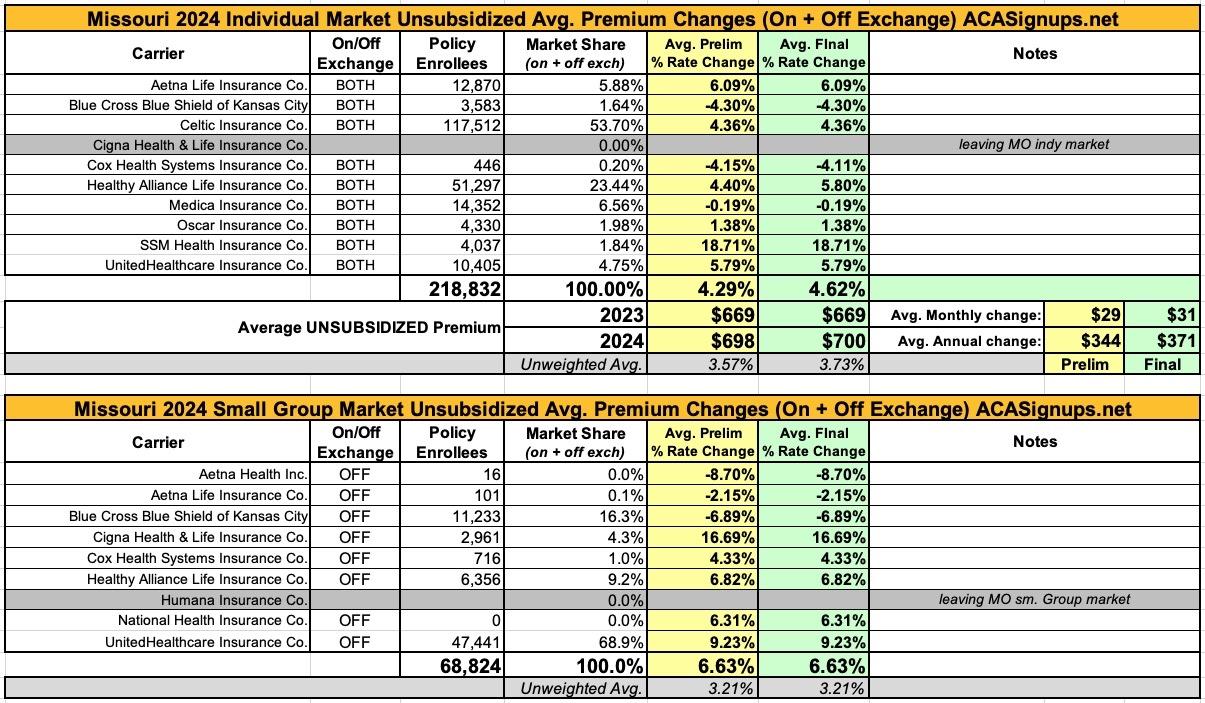

Missouri: *Final* avg. unsubsidized 2024 #ACA rate changes: +4.6%

Back in July I posted Missouri's preliminary 2024 rate filing requests from individual & small group market carriers; the weighted average across all 9 carriers on the individual market was 4.3%, while it was 6.6% for the small group carriers.

Yesterday the Missouri Insurance Dept. posted the final/approved filings along with this press release:

Missouri Department of Commerce and Insurance releases health insurance rates for 2024 with more choices for Missourians

- Missourians should shop around when looking for health insurance coverage on the individual market; most will find they have many choices for plan year 2024

Jefferson City, Mo – The Missouri Department of Commerce and Insurance (DCI) announces the release of final health insurance rates for Missouri’s 2024 individual market.

“I am pleased Missourians will continue to have more choices for plan year 2024,” said Chlora Lindley-Myers, Director of the Missouri Department of Commerce and Insurance. “We will have nine carriers offering individual market coverage in the state, and our department encourages consumers to shop carefully for health insurance coverage.”

As in previous years, Missouri has at least one insurance company offering health plans in every county in the state. Two carriers will significantly increase their footprints in Missouri in 2024, with United Healthcare providing coverage in an additional 47 counties, and Aetna providing coverage in an additional 22 counties. Oscar is also increasing its footprint in the Kansas City area, adding coverage in an additional seven counties.

Over 75 percent of Missouri’s counties now have three or more carriers offering coverage in the individual market (90 out of 115), and nearly a third of the counties in the state have five or more carriers offering coverage (36 of 115). The 115 jurisdictions include 114 counties plus the City of St. Louis.

Missourians can find more information about the rate review process and review rate information on DCI’s website here.

Annual open enrollment for health insurance coverage in the next plan year begins November 1. For coverage to start January 1, consumers must enroll or change their plan by December 15. Consumers that miss the December 15 deadline have until January 15 to enroll; however, coverage will not begin until February 1 for consumers who enroll after December 15.

When shopping for health insurance, it’s important to consider more than just cost. It’s also important to understand what services the policy will cover, the costs you’ll be responsible for, and your current and potential future health care needs, from anticipated surgeries to prescription drugs.

It’s also vital to check provider networks to make sure your current providers are in the network of the plan you are considering. There are provider directories online, but the department strongly encourages consumers to also contact their healthcare providers directly to make sure they are will be in network with the health plan for the upcoming year to avoid any issues later. A health carrier’s provider directory provides a snapshot in time of the plan’s network. Talking directly to your healthcare providers allows you to stay up to date about your provider’s current and future participation in a particular plan’s network.

Review and compare the costs associated with each plan, including all of the out-of-pocket costs you may have to pay – premiums, deductibles, co-pays, and co-insurance amounts. It’s important to get the advice of a trusted insurance agent or assister to review policies and coverages.

Be wary of any advertisements or solicitations that tout low cost or no cost health coverage. Ask questions about the type of policy before you buy. Some plans are lower cost because they may not provide the same level of protection or coverage that is provided by comprehensive major medical health insurance plans. You can check DCI’s Health Insurance Shopping Tool for additional tips to find the policy that meets your needs. If something seems too good to be true, it likely is.

For any insurance questions, Missouri consumers can call DCI’s Insurance Consumer Hotline at 800-726-7390 or visit here.

DCI is charged with protecting Missouri consumers through oversight of the insurance industry, banks, credit unions, utilities, and various professional licensees operating in the state. For more information about the department, please visit our website at dci.mo.gov.

Here's the direct link to the rate summaries, reformatted in the table below. Nothing changed on the small group market, and only a few rates were tweaked in the individual market (mostly Healthy Alliance). The other big news is Cigna dropping out of the indy market and Humana dropping small group coverage.