Kentucky: *Final* avg. unsubsidized 2024 #ACA rate changes: +3.5% (unweighted; updated)

Originally posted 8/09/23; updated 11/03/23

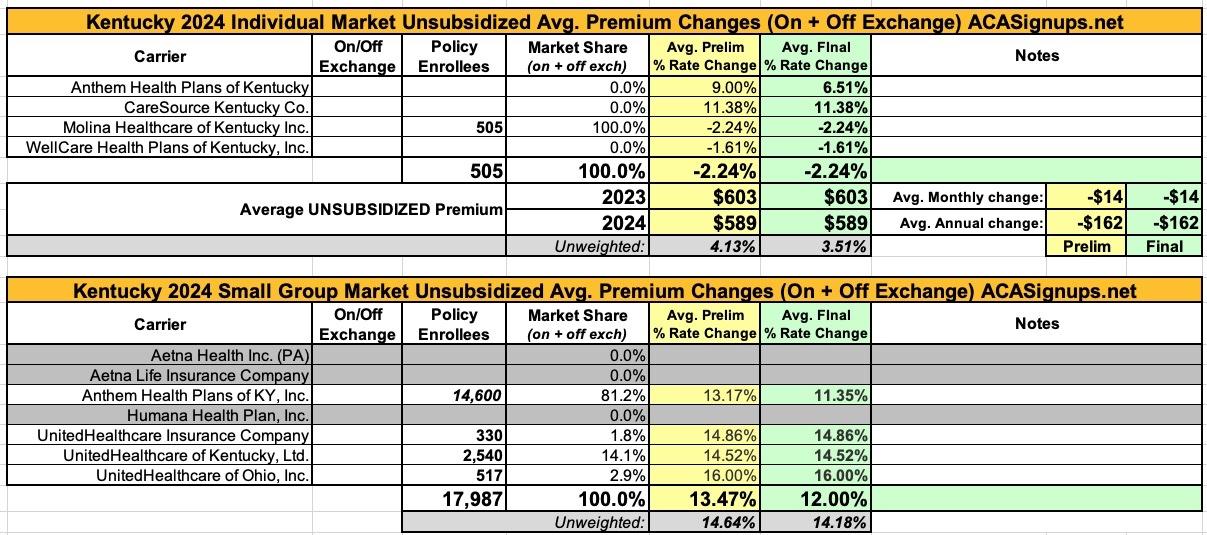

Kentucky is yet another state where the actuarial memos are heavily redacted, making it difficult to acquire information such as the number of enrollees...which in turn makes it impossible to run a weighted average requested rate change for the individual or small group markets.

There are four carriers offering policies on the KY individual market (Anthem, CareSource, Molina and WellCare), with an unweighted average rate change request of 4.1%. Molina has provided an unredacted actuarial memo which includes their enrollment...but it's only 505 people, while KY's total indy market is likely closer to 75,000 or so including the off-exchange market.

The small group market is more interesting--for starters, both Aetna and Humana (again) appear to be pulling out of the state, leaving just four carriers, and of those, unredacted filing summaries are available for three (the 3 UnitedHealthcare variants). KY's total small group market was roughly 24,000 people last year, with Aetna and Humana having a combined 6,000 enrollees. That should leave Anthem with roughly 14,600 enrollees; if so, that would put the small group weighted average at around 13.5% vs. the 14.6% unweighed average shown below.

UPDATE 11/03/23: The final/approved rates have been posted to the federal rate review database. The only changes are to Anthem, which saw their individual market rate increases drop from 9% to 6.5% and their small group plans go from a 13.2% increase to 11.4%.

From the Anthem individual market filing:

Scope and Range of the Rate Change

This filing includes an average rate change of 9.0%, excluding the impact of aging, effective January 1, 2024. At the individual plan level, rate increases range from ‐4.0% to 17.2% for renewing plans. A subscriber’s actual rate could be higher or lower depending on the geographic location, age characteristics, dependent coverage, and other factors.

Financial Experience

Anthem expects the proposed rate increase will cover projected medical trends and yield a medical loss ratio of 84.4%, meaning more than eighty‐four cents of each premium dollar are expected to go to covering our members’ medical expenses and improving health care quality. This projected MLR of 84.4% exceeds the minimum MLR requirement of 80% as defined in the Affordable Care Act (ACA). In the event Anthem’s MLR is less than the Federal required minimum for a three‐year period, Anthem will refund the difference to policyholders, consistent with federal regulations.

Significant Cost Components

The primary driver of the premium increase is the increases in the cost of healthcare. The increases are associated with increases in the “unit” cost of services primarily from hospitals, physicians, and pharmaceutical companies, coupled with increases in the consumption of services, or “utilization”, by members. Increases in the unit costs of services are driven by many things, including technology advances, cost shifting to private insurers due to reductions in Medicaid and Medicare reimbursement, general inflationary pressures, and a variety of other factors. In particular, the costs of new prescription drugs will continue to have a notable effect on pharmacy inflation.

Anthem continues to effectively manage administrative and selling costs. Anticipated profits are not expected to materially change such that the changes would impact the proposed rate increase. The Affordable Care Act requires that no less than 80% of a health insurer’s premium dollars go to medical expenses, otherwise a premium rebate to employers and subscribers must be generated to refund the difference. Accordingly, Anthem files premiums targeting compliance with that requirement.

What is Anthem doing to keep premiums affordable?

Anthem is investing in many initiatives designed to improve patient safety, outcomes, and health while reducing medical cost trends and allowing our members to better manage their health and health care costs. For instance, we are collaborating with providers through value based payments models that reward them when they provide high‐quality, evidence‐based care, which reduces costs over time by, among other things, improving health and reducing or eliminating avoidable ER visits and admissions. This includes programs designed to promote and support patient‐centered care models under which Anthem gives primary care physicians tools and resources to proactively manage the overall health of their patients and coordinate their care across all settings. It also includes hospital pay for performance programs where Anthem rewards hospitals when they meet patient safety, outcome, and satisfaction measures.

In addition, we continue to negotiate the best possible rates for covered services and through our Estimate Your Cost tool, help our members make informed health care purchasing decisions by allowing them to compare costs and quality for hundreds of procedures at different facilities and estimate their out of pocket expenses.

Finally, we are dedicated to working with our members to find health coverage plans that are the most appropriate, beneficial, and affordable for their needs.

CareSource's "Customer Justification" is...well..I'm gonna have to post a screen shot of the entire thing:

Proposed Rate Change(s) Molina’s 2024 rate filing reflects the following rate changes by metal tier. The 2024 rate changes vary by metal tier due to changes in the Actuarial Value (AV) Pricing Values assigned to each metal plan that are applied to the Plan Adjusted Index Rate. Molina has 505 members in plans that are renewing enrolled effective March 2023 and reported as of April 2023. The rate change calculation below is consistent with Worksheet 2, Section II of the URRT, which only includes members on renewing plans.

Reason for Rate Change(s)

The following factors contribute toward the overall change in the proposed rates.

- Claims: Projected claims for 2024 are expected to contribute toward a -2.2% decrease in rates due to updated base period experience claims, trend, changes in product, acuity, and demographic mix, and the impact of normalizing for COVID-19 on the base period experience.

- Taxes and Fees: Taxes, fees, and retention are expected to contribute toward a -0.1% decrease in rates.

- Margin: Margins are expected to contribute toward a -0.0% decrease in rates at our company standard 3.0% after-tax profit margin.

- Risk Transfer: Risk transfer is expected to contribute toward a 0.3% increase in rates due to differences in actual versus expected risk transfer amounts for the 2022 benefit year and expected changes in 2024 population mix.

- Administrative Expenses: Administrative expenses are expected to contribute toward a -0.4% decrease in rates due to higher plan, corporate and QA expenses, offset by lower expected broker commissions.

- Membership Mix: The membership mix from Texas in 2022 to Kentucky in 2024 compared to the membership mix for comparable time periods from the prior year rate filing is expected to contribute toward a 0.3% increase in rates.

Rate changes vary by metal tier due to changes in Actuarial Value, Cost Share Design (CSD), and Geographic factors.